Every investor cannot have smooth sailing in the trading process, and sometimes it is inevitable to make some wrong decisions, so stop loss ( English : Stop Loss) is very important for all investors, even Warren Buffett has to stop loss! Because in the ever-changing investment market, it is inevitable to face different degrees of risk. How to control the risk determines who is the final winner. This article will introduce the operation method of setting stop loss on the ST7 platform, as well as the principles and techniques of stop loss.

Before we go into the details of stop loss, let us first introduce a story called the Alligator Principle .

" When we encounter a reverse trend and face a paper loss today, it is like a foot being firmly bitten by a crocodile. If we continue to increase the position, flatten it, or increase funds or adjust the position ratio, it is actually futile. It is like using your hand to pry open the crocodile's mouth. In the end, your hand will be bitten together. The most correct way at this time is to sacrifice your bitten foot, which also means immediately stopping the loss order to prevent further damage. "

This little story basically explains the meaning and importance of stop loss.

Traders who don't know how to set stop losses usually monitor the market trend closely. Whether the market is favorable or unfavorable, they will make a judgment on the spot and decide whether to arbitrage or stop loss. But is this really the case? In fact, when these traders make decisions, profitable transactions are often closed early due to concerns about giving back gains, while losing transactions are unwilling to admit losses, constantly looking forward to the day when prices fall back, causing the snowball to roll bigger and bigger, and finally the funds collapse and all the money is lost. This verifies the truth of "entering the market due to greed and exiting the market due to fear". In the long run, small profits and big losses are the result, and this is also the problem that most traders are troubled by.

The problem is, what usually happens to us is that when we see the right market trend, once we encounter some short-term headwinds, setting a stop loss may cause us to exit the market during the volatility, and we may also miss out on the profits that will naturally flow from the subsequent market.

However, we cannot always accurately judge which one is a short-term headwind . If we do not set up a stop-loss mechanism, in the medium and long term, the best situation is that the gains and losses are equal, and those who can make big profits are likely to be lucky. Only if we design a set of stop-loss standards that suit us and regularly invest them in actual trading, effectively controlling the risk of big losses, can we pursue steady profits in the long term. When making money, you can make big or small profits, and when losing money, it is basically just a small loss, filtering out the big losses.

Therefore, how to set stop loss is the top priority.

Before teaching how to take the most preliminary risk control measures, let’s first talk about how to set stop loss for trading orders on the ST7 platform.

Case 1: Setting a stop loss when opening a position

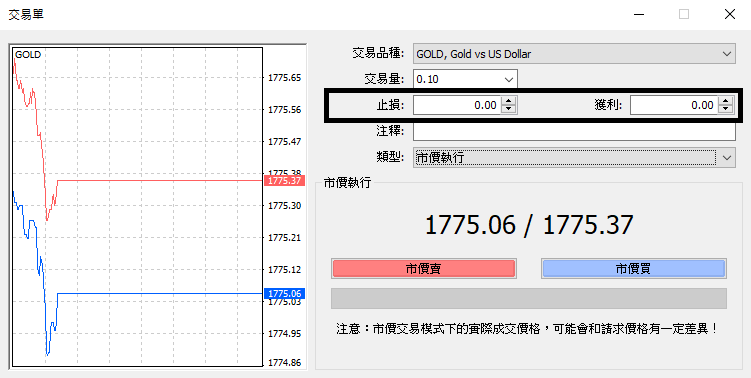

When you click on the new trading order to establish a position, you will see the position opening confirmation screen below. Before opening a position, in addition to setting the position size, you can also enter a custom value in the "Stop Loss/Take Profit" column below. When the market falls to the price we set, it can automatically trigger the exit operation.

Screenshot 1: How to set a stop loss when opening a position

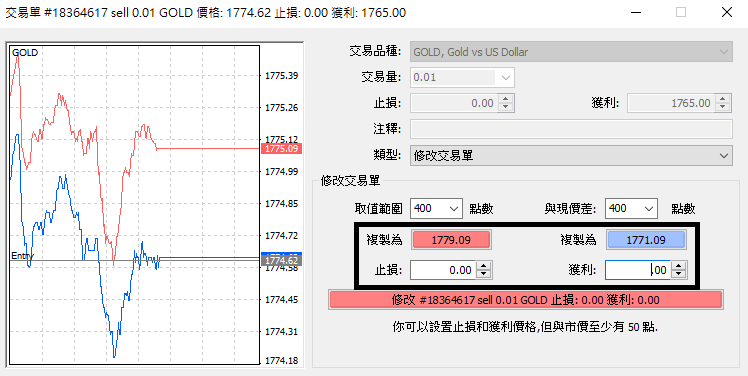

If you want to adjust the take profit and stop loss on an already established position, you can first open the terminal page below, then right-click on the order to be adjusted, select the "Modify or delete transaction order" option, and you will see the screen shown in the picture below. At this time, you can set the take profit and stop loss for the transaction order.

Screenshot 2: How to set a stop loss on an established position

After talking about the significance of stop loss and how to set stop loss manually, the next step is to teach you how to set stop loss " cleverly " . After all, stop loss skills may be a key to success, and it can also be said to be an art in trading.

If it is set too far, it will have limited help in risk control of transactions; if it is set too close, you may be swept out of the market at any time.

For some beginners, they can simply set stop loss according to certain basic principles. Although there is no special skill involved, it is definitely helpful for the entire trading strategy and deployment.

1/ Calculated by price distance

Calculated by the entry price, whenever a predetermined distance is reached in an unfavorable direction, a stop loss is required. For example, if the entry price is 30 pips, such as bullish EUR/USD, the buying price is 1.1300, and the stop loss is set at 1.1270. Or, if calculated by volatility, if a drop of 0.3% is set, that is, a drop of about 34 pips, the stop loss is set at 1.1266.

2/ Calculated based on the take-profit and stop-loss ratio

The distance of stop loss should be in reasonable proportion to the distance of take profit. For example, if the profit target is 30 pips per transaction, the distance of stop loss will not be more than 30 pips. You can use a one-to-one ratio (30 pips for take profit and 30 pips for stop loss) or a two-to-one ratio (30 pips for take profit and 15 pips for stop loss), or adjust the ratio between the two.

3 / Calculated based on capital ratio

The loss of each transaction should not exceed a certain proportion of the funds in the account. You can use 5%-10% as a reference to determine the stop loss rule. The more funds in the account, the greater the pressure you can bear. For example, if you have $1,000 in the account and hold a long order of 10,000 euros, the stop loss distance can be set at most 100 pips, that is, the loss of $100 is the upper limit. The loss of a transaction cannot exceed 10% of the funds.

4/ Combined with technical analysis

Those who specialize in technical analysis, on top of the above principles and logic, mostly mix the analysis techniques on the chart to set the stop loss. Common methods include drawing trend lines, observing the trend pattern, and positioning with technical indicators such as average lines, in order to determine reasonable support and resistance levels, and set stop losses to prevent some breakthroughs. Among technical indicators, statistical indicators such as ATR can also be used to measure the recent volatility of some trading targets to avoid setting stop loss distances inappropriately.

All financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary.